Please consult with M&A DX for any inquiries.

M&A DX provides 22 various supports in the area surrounding M&A such as FA service, business succession, business revitalization and marketing.

We offer extensive solutions that cover all the concerns of business owners.

M&ADX provides services tailored to business owners across Japan with offices in Tokyo, Osaka, Nagoya, and Fukuoka. Through collaboration with financial institutions and professionals nationwide, we provide the best possible services to address the concerns of business owners and maximize the number of potential candidates in M&A transactions.

More than 50% of our team members are M&A specialists who are certified accountants, lawyers, and tax accountants. Throughout the M&A process, we provide full support from these experts. We value listening to our clients' concerns first and foremost, and our principle is to "sit together and listen". We listen carefully to the issues that business owners face, think together about the best solutions, and optimize M&A and business succession by combining digital and analog areas. Please feel free to contact us for a consultation.

*As of September 1st, 2022.

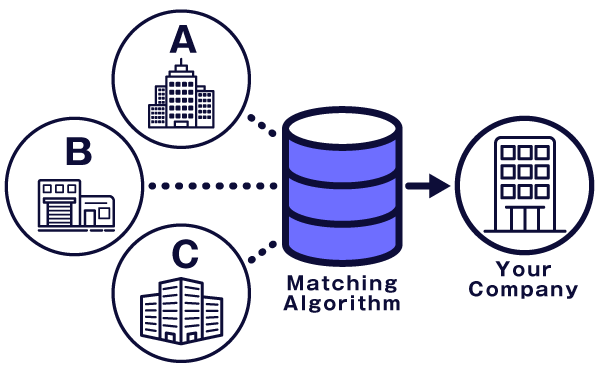

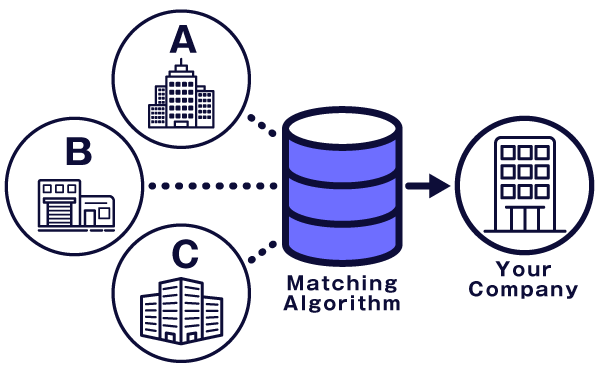

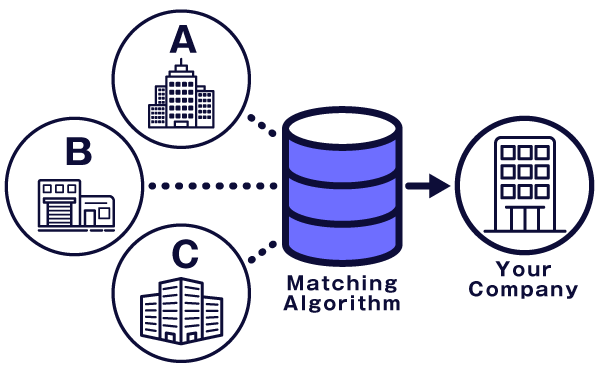

M&A DX has developed a proprietary matching algorithm based on accumulated data from our past achievements and needs. We will introduce you to the most suitable target candidates.

With a team of qualified professionals such as certified public accountants, tax accountants, and lawyers, we provide support for M&A consultations, negotiations, and even post-merger integration. You can choose to utilize only the services you need depending on your specific needs

Certainly, in the past, M&A was limited to a few large corporations, but now the scope has expanded to include mid-sized and small businesses. The background to this is that with the increasing number of older owners and managers, mainly from the baby boomer generation, there has been a growing problem of business succession due to a lack of successors. In addition, there are also an increasing number of younger owners and managers who are considering joining a larger company for the growth and development of their own business.

We will perform a simple stock price calculation during the free consultation, so please take advantage of this service. When you officially start considering M&A, M&ADX experts will perform a stock price calculation, taking into account your company's specific and individual circumstances (reserves, tax effects, intangible value, etc.). Based on the results of this calculation, we will discuss with you and consider your company's share price target.

Although it varies depending on the company's situation, it generally takes from 6 to 9 months. 6 to 9 months may seem like a long time to some, but both the transferor (seller) and the transferee (buyer) are usually very careful because of the high importance of the project. Depending on the size of the project, industry conditions, and other factors, the project may take more than a year to complete, or it may be completed in as little as three months. In any case, it is important to proceed with the process with a good understanding of the client's intentions (e.g., to proceed quickly or to take time to assess the situation).

At M&ADX, confidential information will not be divulged because of our strict confidentiality policy regarding M&A. We take the utmost care in the location and method of communication with our clients to ensure that confidential information is not divulged to any of their employees or business partners. We take the utmost care in our meeting locations and communication methods to ensure that confidential information is not leaked to our clients' employees or business partners. some financial institutions are in partnership with M&ADX, but please rest assured that we will obtain your permission before disclosing any information. In addition, we always ask potential candidates to submit a confidentiality statement before disclosing any information that may identify you.

M&A is a specialized area, and there are still not many employees with knowledge in the company. It is important to avoid the following risks by not appointing a specialist, and to ensure smooth execution of the transaction. The company may not be able to find a counterparty in the first place. The stock price (business transfer consideration) may be set at a disproportionately low (or high) price. The relationship with the counterparty deteriorates due to many emotional aspects. The process progresses with ambiguous agreements, and problems arise at a certain point in the process, resulting in a mutually frustrating outcome. Even if an M&A deal is concluded, problems arise after a while due to insufficient documentation in various phases.

As a prerequisite, you should identify a trustworthy expert. Please refer to the following points to determine whether or not they are trustworthy. Is the specialist in charge of the M&A transaction experienced and proven in the M&A field? Since it will be a long term relationship, is the person in charge friendly and personable? Is the fee burden light at first, and is the ratio of contingency fee high (tail heavy)? Recently, we have heard of broker-like companies and companies with respectable signs but amateurs in charge, so it is advisable to carefully examine the person in charge.

In this case, frankly speaking, it is not easy, but M&A is a possibility. This may be due to unexpected factors or tax-saving measures taken by the client, or because the client may have important permits and licenses, etc. It is difficult to make a blanket statement, so please feel free to proceed to a free consultation first.

M&ADX offers free consultations on M&A, business succession, and inheritance. We not only respond to consultations by e-mail but also offer free consultations in person. Please feel free to contact us.

Of course, it is important, so you can consult with us after you have made a decision on M&A, etc. On the other hand, since M&A is not something you will do many times in your lifetime, most of you may not have much knowledge about it. We are happy to consult with you and help you find the best plan for your business.

The contents of consultation vary from person to person, but the main topics of consultation are as follows. I am wondering whether to succeed the business within the family or outside the family (M&A). If the business is to be taken over by a family member, they are concerned about inheritance tax. How much will the company's stock price (consideration for transferring the business) be? I want to proceed with M&A, but I don't want my company's employees or business partners to know about it. Can we find a partner for M&A? How long will the M&A process take?

Yes, of course it is possible. We will visit you anywhere in Japan free of charge.